Greatest Real money Casinos on the internet Playing Within the 2024

05/07/2024The fresh On the web Blackjack Newest Blackjack Websites

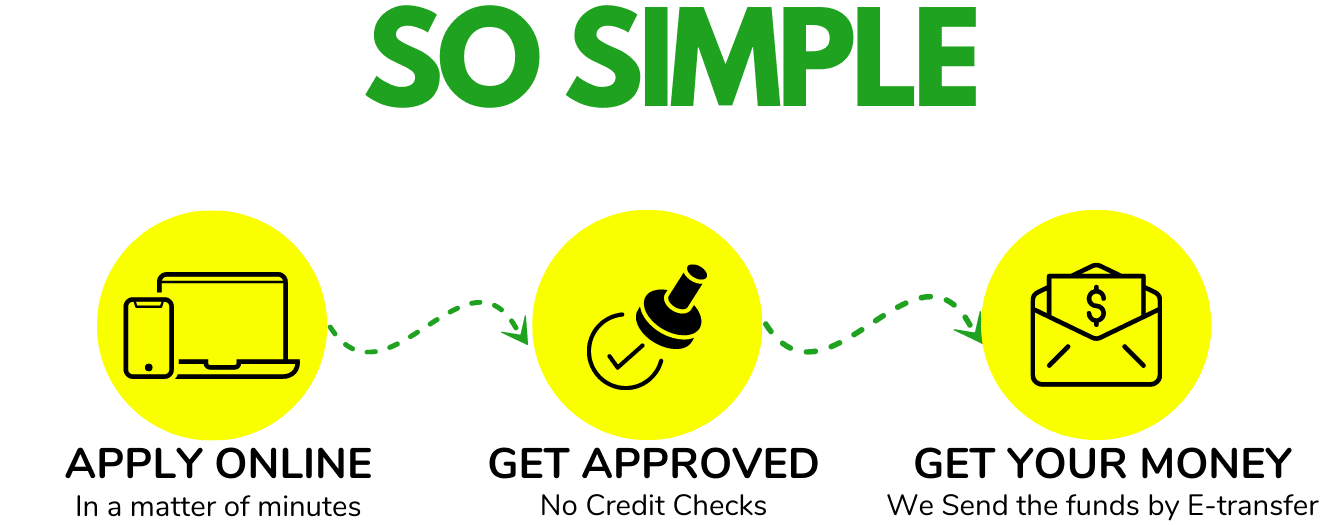

05/07/2024Such mortgage has the benefit of a speedy and accessible money choice since you may get recognition within just one-day, even although you has bad credit. Once you get the mortgage having bad credit, you possibly can make each and every day otherwise a week money for one to seasons.

But not, short-label loans generally incorporate highest interest levels. Ergo, if you want to bring these types of less than perfect credit finance, remain one to in your mind when making payments because of it version of less than perfect credit loan.

Taking financing out of close friends and you may family are tricky. Even in the event for example a loan may well not require a credit check , it does probably destroy an important dating in the event the things go awry.

Therefore, you should probably simply look at this alternative because the a last resorts. Only do so if you’re sure you’re able to honor your own guarantee out of cost. Even though this style of mortgage mostly relies on good faith from both the bank and you may debtor, generate that which you specialized because of the drafting that loan contract.

Certainly spell out the mortgage words, in addition to rate of interest, time of this new payment, and fees loan amounts. This helps stop damaged dating, hurt thoughts, and you may you’ll be able to court tussles from preventable disputes.

Benefits of Bringing a loan Off a virtually Loved one or Friend Were:

- Recognition and mortgage words might not necessarily rely on the borrowing rating

- Choosing the bucks quickly

- The newest fee bundle was flexible and versatile

- The rate is reduced if not low-existent

- Zero credit check

Cons of getting that loan Away from a member of family otherwise Pal Include:

- Placing a significant relationship at stake

- You simply can’t easily borrow large amounts

- Alterations in their relationships can negatively affect the loan terms and conditions

- You can also deal with suit to possess minor disagreements

15. Cash advance having Poor credit

Pay-day lenders generally you should never look at the borrowing from the bank whenever deciding whether to make you a loan. Considering a survey of the CNBC, 11% away from adults in the us have chosen to take out a pay-day poor credit financing. Furthermore, payday loans was an astonishing $9 billion team in america. Providing funds for poor credit attracts many people contained in this condition.

New extensive access to such financing because of the people who have less than perfect credit results has plenty regarding how effortless he’s to locate. You just need an appropriate ID, savings account, zero credit assessment, and sufficient evidence of income. When you are getting the mortgage, the primary, services fees, and attention are normally owed on your own second payday. They might be intended for small-name monetary requires. The typical cash advance number is approximately $five-hundred and you can usually boasts large charges than other money. The attention alone can result in some cash advance as a good bit costlier than many other type of poor credit funds.

Up to that one might provide small funding, the user Financial Safety Bureau indicated that the brand new charge energized to have a regular a couple-week payday loans result in an apr (APR) of around eight hundred%. This can be greater than brand new Annual percentage rate toward credit cards, and that range off 12% to 31%.

If you take a $five-hundred pay day loan because of your credit rating, from the an apr from 391%, you are going to shell out $575 14 days after. Yet not, certain individuals have a http://cashadvancecompass.com/loans/payday-loans-that-accept-netspend-accounts/ tendency regarding running more than the cash advance from time to time. If you do that for around 3 months, in your $500 financing, extent might are obligated to pay might possibly be more $step one,one hundred thousand.

Particular states do not render online payday loans , when you’re almost every other says have put tighter guidelines to ensure consumers are safe.